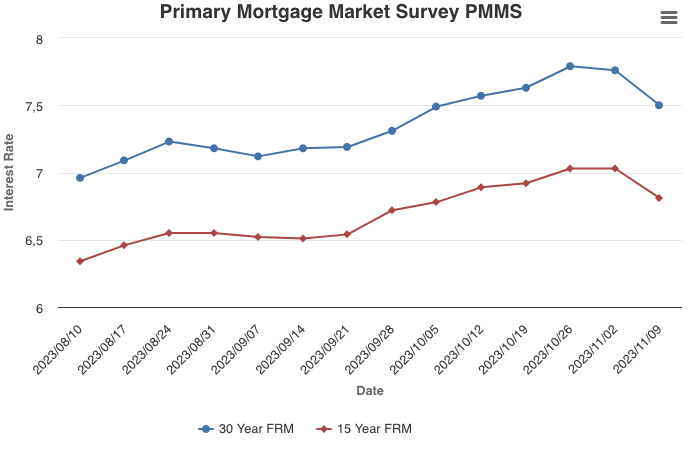

November 9, 2023

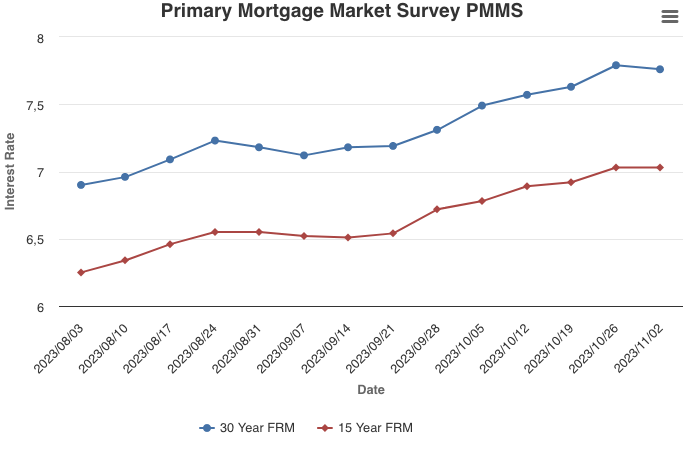

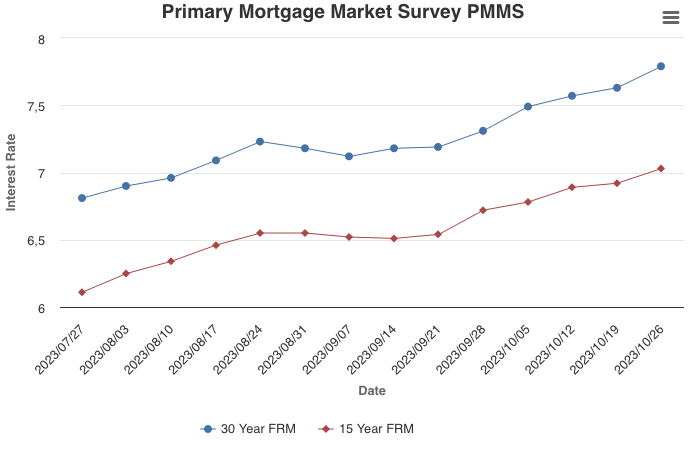

As Treasury yields decline, the 30-year fixed-rate mortgage dropped a quarter of a percent, the largest one-week decrease since last November. Incoming data show that household debt continues to rise, primarily due to mortgage, credit card and student loan balances. Many consumers are feeling strained by the high cost of living, so unless mortgage rates decrease significantly, the housing market will remain stagnant.

Information provided by Freddie Mac.

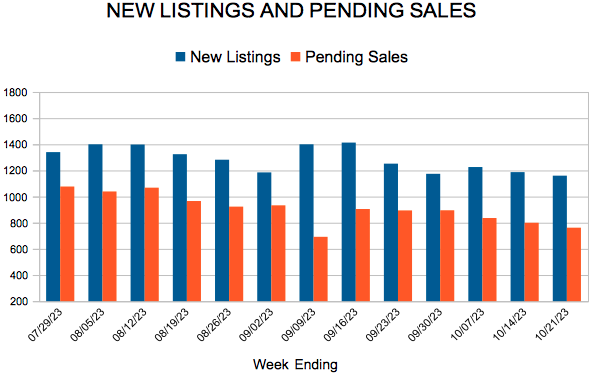

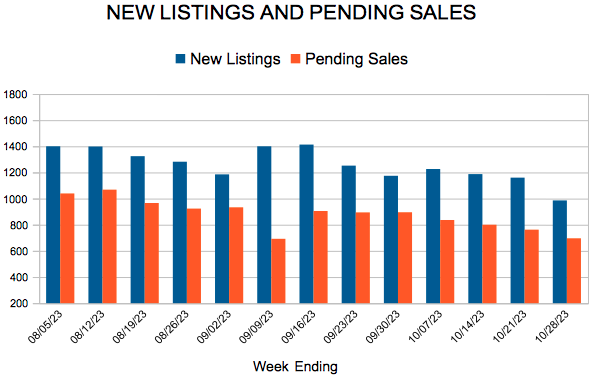

For Week Ending October 28, 2023

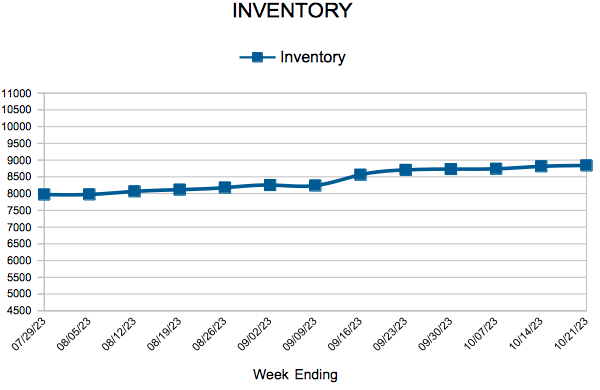

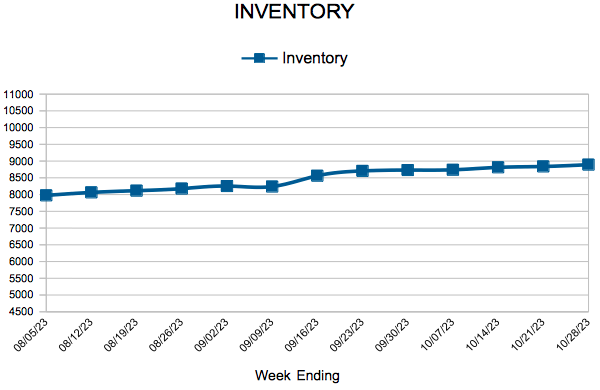

For Week Ending October 28, 2023